Loading

Get Personal Monthly Budget Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Personal Monthly Budget Form online

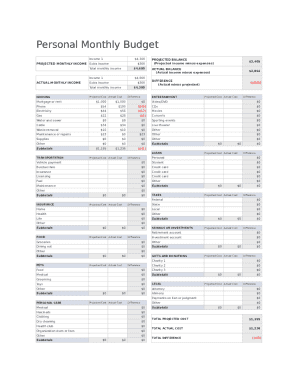

The Personal Monthly Budget Form is an essential tool for individuals looking to manage their finances effectively. This guide provides clear instructions on how to complete the form online, ensuring your budgeting process is streamlined and efficient.

Follow the steps to complete the Personal Monthly Budget Form online.

- Click the ‘Get Form’ button to obtain the form and access it in your preferred online editing tool.

- Begin by entering your projected monthly income in the designated fields for ‘Income 1’ and ‘Extra Income’. This will provide you with a comprehensive view of your total monthly income.

- Next, record your actual monthly income in the corresponding fields. This section allows for comparison between projected and actual figures, assisting in better financial planning.

- Proceed to the housing section where you will enter both projected and actual costs for mortgage or rent, phone, electricity, and gas. This is crucial for understanding your housing expenses.

- Continue to the entertainment section where you can input projected and actual costs for various entertainment activities, including movies, concerts, and sporting events. Ensure to note the difference between projected and actual costs.

- Fill out the transportation section, where you will enter any relevant costs associated with vehicle payments, public transport, and related expenses.

- In the insurance section, enter details for health insurance, life insurance, and any other relevant insurance costs, ensuring both projected and actual figures are noted.

- Record your food expenses, including groceries, dining out, and other food-related costs in their respective fields.

- Document any savings or investments you are planning or currently managing, along with any contributions to retirement or investment accounts.

- Complete the gifts and donations section detailing any charitable contributions or gifts you plan to give.

- Finally, review all sections for accuracy. Once completed, you can save your changes, download the form, print it, or share it as needed.

Start managing your finances today by completing the Personal Monthly Budget Form online!

Gather Your Financial Paperwork. Before you begin, gather up all your financial statements, including: ... Calculate Your Income. ... Create a List of Monthly Expenses. ... Determine Fixed and Variable Expenses. ... Total Your Monthly Income and Expenses. ... Make Adjustments to Expenses.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.