Loading

Get Year-end Tax Plan Template

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Year-End Tax Plan Template online

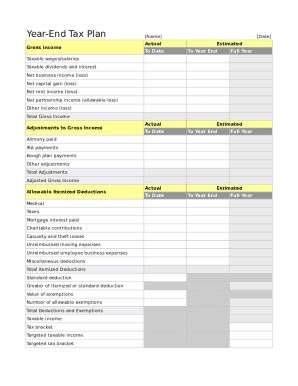

Filling out the Year-End Tax Plan Template online can help you gain a clearer understanding of your financial situation as the year comes to a close. This guide provides clear instructions on how to accurately complete each section of the form for your tax planning needs.

Follow the steps to efficiently complete the Year-End Tax Plan Template.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the Gross Income section, input your name, actual income to date, and estimated income to year end for each category: taxable wages/salaries, taxable dividends and interest, net business income (loss), net capital gain (loss), net rent income (loss), net partnership income (allowable loss), and any other income (loss). Finally, calculate the total gross income.

- Move to the Adjustments to Gross Income section. Enter actual amounts to date and estimated amounts to year end for alimony paid, IRA payments, Keogh plan payments, and any other adjustments. Calculate the total adjustments.

- Determine your adjusted gross income by subtracting your total adjustments from your total gross income.

- In the Allowable Itemized Deductions section, list your deductions for medical expenses, taxes, mortgage interest paid, charitable contributions, casualty and theft losses, unreimbursed moving expenses, unreimbursed employee business expenses, and miscellaneous deductions. Calculate the total itemized deductions.

- Determine if you will take the standard deduction or the greater of itemized or standard deduction. Include the value of exemptions and the number of allowable exemptions.

- Calculate total deductions and exemptions, then subtract this amount from your adjusted gross income to find your taxable income.

- Identify your tax bracket and targeted taxable income alongside the targeted tax bracket based on your taxable income.

- Review all entered information for accuracy. Once confirmed, you can save your changes, download a copy, print it for your records, or share it as needed.

Start completing your Year-End Tax Plan Template online today!

It is a practice where one analyzes his financial situation based on tax efficiency point of view so as to invest and utilize the resources optimally. Tax planning means reduction of tax liability by the way of exemptions, deductions and benefits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.