Loading

Get Business Indebtedness

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Business Indebtedness online

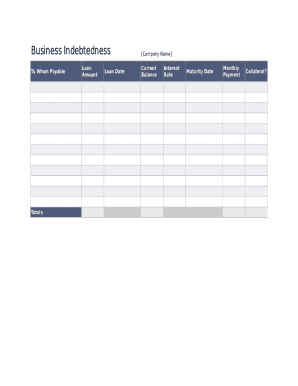

Completing the Business Indebtedness form online is an essential process for properly managing your business's financial obligations. This guide provides clear instructions to help you fill out the necessary fields accurately and efficiently.

Follow the steps to fill out the Business Indebtedness form

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- In the section labeled 'To Whom Payable,' input the name of the lender or financial institution to which your business is indebted.

- Next, locate the 'Loan Amount' field and enter the total amount borrowed.

- In the 'Loan Date' section, provide the date when the loan was issued.

- Proceed to 'Current Balance' and specify the amount that is currently outstanding.

- Fill in the 'Interest Rate' with the annual percentage rate associated with the loan.

- Enter the 'Maturity Date,' which is the date by which the loan must be fully repaid.

- Indicate the 'Monthly Payment' amount that your business is required to pay.

- For the 'Collateral?' section, state whether there is any collateral tied to the loan. If yes, specify what the collateral is.

- In the field labeled 'Current or Past Due Amt.,' record any amounts overdue if applicable.

- Once all fields are completed, make sure to review your entries for accuracy. After confirming the details, you can save your changes, download the form, print it, or share it as needed.

Complete your business indebtedness document online today for effective financial management.

In fact, there is a code for the 1099-C that appears to be tailor-made for debt settlement reporting: Code F By agreement. Code F is used to identify cancellation of debt as a result of an agreement between the creditor and the debtor to cancel the debt at less than full consideration. Source.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.