Loading

Get Payroll Register Template

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Payroll Register Template online

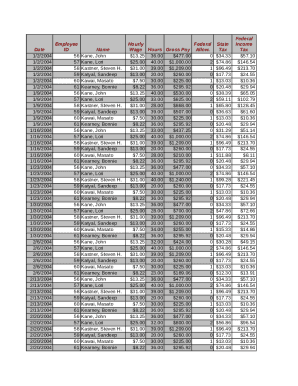

Filling out the Payroll Register Template is an essential task for accurately tracking employee wages and withholdings. This guide will help you navigate each section of the form efficiently while ensuring compliance with payroll regulations.

Follow the steps to complete the Payroll Register Template online.

- Click ‘Get Form’ button to access the Payroll Register Template and open it for editing.

- Begin by entering the 'date' for each payroll period. This is crucial for maintaining accurate records.

- In the 'Employee ID' section, enter the unique identification number for each employee. This helps to differentiate and track payroll data effectively.

- Next, input the 'name' of each employee. Ensure that names are spelled correctly to avoid discrepancies in payroll records.

- Fill in the 'Hourly Wage' field with the respective rate for each employee. This is important for calculating the gross pay.

- In the 'Hours Worked' section, record the total number of hours each employee worked during the pay period.

- Proceed to calculate and enter the 'Gross Pay' for each employee. This is done by multiplying the hourly wage by the hours worked.

- Complete the 'Federal Tax' and 'State Tax' categories by inputting the relevant withholding amounts for each employee as required.

- Continue with the 'Social Security' and 'Medicare' tax withholdings, ensuring that all amounts are up to date.

- In the 'Insurance Deduction' section, record any applicable deductions for employee benefits.

- Finally, calculate the 'Net Pay' by subtracting all tax and deduction amounts from the gross pay for each employee.

- Once all entries are completed, you can save the changes, download the document, print it for your records, or share it as needed.

Start filling out the Payroll Register Template online to maintain accurate payroll records.

The salary slip sheet uses the VLOOKUP Function to program the sheet. On the extreme right, select the name of the employee from the drop-down list. The template displays the salary data of the respective employee. Click on the print button to print the Salary Slip.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.