Loading

Get Business Structure Selector

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Business Structure Selector online

The Business Structure Selector is an essential tool for individuals looking to determine the best business structure based on their specific needs. This guide provides clear, step-by-step instructions to help users navigate the form with confidence.

Follow the steps to effectively complete the Business Structure Selector online.

- Press the ‘Get Form’ button to access the Business Structure Selector and open it in your chosen editing tool.

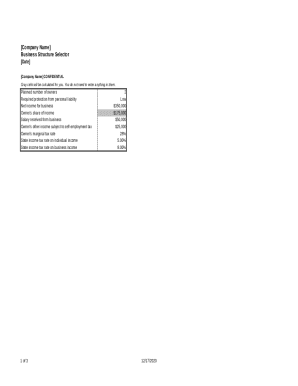

- Begin by filling out the planned number of owners. This information helps in determining the appropriate business structure.

- Next, indicate the required protection from personal liability. Users can select the level of protection they wish to have.

- Enter the anticipated net income for the business. This field assists in evaluating the financial impact of different structures.

- Provide the owner's share of income, clearly indicating how profits will be distributed among owners.

- Input the salary received from the business. This helps in tax liability calculations.

- Indicate any other income the owner receives that is subject to self-employment tax to ensure accurate tax assessments.

- Specify the owner's marginal tax rate and the state income tax rates on both individual and business income, as these will influence tax obligations.

- Look for the options that apply to the type of business structure you are considering: Sole Proprietorship, Partnership, Corporation, Limited Liability Corporation (LLC), or S Corporation.

- Make sure to review all filled fields for accuracy before moving on to calculations.

- Once all sections are complete, you have the option to save your changes, download, print, or share the completed form.

Start completing your Business Structure Selector online today to find the best fit for your business needs!

Content. Your business structure affects how much you pay in taxes, your ability to raise money, the paperwork you need to file, and your personal liability. You'll need to choose a business structure before you register your business with the state.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.