Loading

Get Employee Payroll Tracker

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Employee Payroll Tracker online

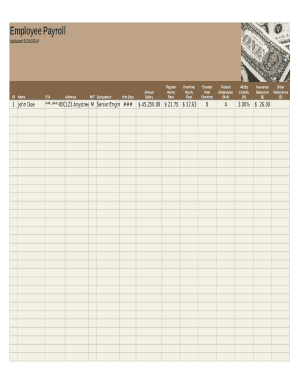

The Employee Payroll Tracker is an essential document for managing employee payroll information effectively. This guide provides clear, step-by-step instructions on how to complete the form online, ensuring that all necessary details are accurately recorded.

Follow the steps to complete the Employee Payroll Tracker with ease.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the ID, Name, and Social Security Number (SS#) fields, ensuring all information is accurate for proper identification.

- Enter the Address of the employee as well as their Gender and Occupation, providing complete details to maintain accurate records.

- Input the Hire Date to specify when the employee started working in your organization.

- Complete the Annual Salary or Regular Hourly Rate field based on the salary structure of the employee, and ensure to clarify the Overtime Hourly Rate if applicable.

- Indicate if the employee is Exempt from Overtime regulations by marking the appropriate field.

- Provide Federal Allowances as per the employee's W-4 form, required for tax calculations.

- Input the percentage of 401(k) contributions for the employee to determine retirement savings.

- Record any applicable Insurance Deductions and Other Deductions where necessary.

- Complete the Payroll Register section detailing Total Hours worked, Payment Date, and Pay Period for thorough tracking.

- Calculate and document Regular Hours, Vacation Hours, Sick Hours, Holiday Hours, Personal Hours, and Overtime Hours worked during the pay period.

- Record Gross Pay, withholdings, and deductions such as Federal Tax, State Tax, Local Tax, Social Security, Medicare, Insurance Deductions, and Other Deductions.

- Finally, calculate and enter the Net Pay for the employee to reflect the amount that will be paid after all deductions.

- Save your changes, and choose to download, print, or share the form as needed.

Complete your Employee Payroll Tracker online today for efficient payroll management.

Track time as you work: Write a description for the time entry. Start the timer, select a project, mark this time as billable or leave it as non-billable. ... Add time manually: Write a description for the time entry. Specify the start and end times, or simply type the number of hours and minutes. ... Add time in a timesheet:

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.