Loading

Get Id Ibr-1 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ID IBR-1 online

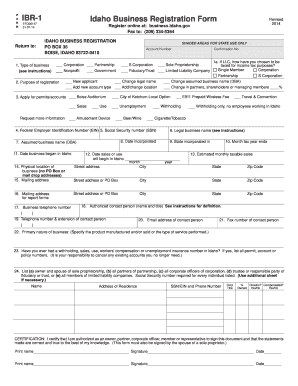

Filling out the ID IBR-1 form is an essential step for registering your business in Idaho. This guide will provide you with a clear and detailed explanation of each section of the form, ensuring you can complete it online with confidence.

Follow the steps to successfully complete the ID IBR-1 form online.

- Click ‘Get Form’ button to begin the process of obtaining the ID IBR-1 form. This action allows you to access the necessary document within the online editing platform.

- Identify the type of business entity you are registering by marking the appropriate box (e.g., corporation, partnership, nonprofit, or government). This information is crucial for classifying your business correctly.

- In the purpose of registration section, select all applicable checkboxes to describe your filing purpose, such as 'New applicant' or 'Change legal name'. Be thorough to ensure you capture the right intent.

- Provide your Federal Employer Identification Number (EIN) if applicable. If you do not have one yet, note 'applied for.' If you are a sole proprietorship and do not require an EIN, leave this field blank.

- Enter your legal business name as it appears on official documents. If the business is a sole proprietorship, ensure you use the name on the owner's Social Security card.

- Fill in the required fields regarding the assumed business name (DBA), if different from the legal name, and ensure it is registered with the Secretary of State.

- Provide the date incorporated if your business is a corporation, along with the state of incorporation.

- Complete sections asking for the physical location of your business and any mailing addresses that differ from the physical location. Ensure no PO Box or mail drop addresses are used.

- Identify the authorized contact person for your business. Include their name, title, telephone number, email address, and fax number. This person will be responsible for communications regarding the application.

- In the primary nature of business section, provide a detailed description of the products being sold or services provided by your business.

- Review your entries for accuracy before submitting the form. After ensuring all necessary sections are filled correctly, save your changes. You may then download, print, or share the completed form as required.

Start filling out your ID IBR-1 form online today to ensure your business is registered successfully.

To register your business in Idaho, you must first choose a business structure, such as an LLC or corporation. Then, you can complete the registration through the Idaho Secretary of State's website. Using resources like ID IBR-1 simplifies this process and provides valuable insights on compliance and necessary forms to submit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.