Loading

Get Buy Vs Lease Car Calculator

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use the Buy Vs Lease Car Calculator online

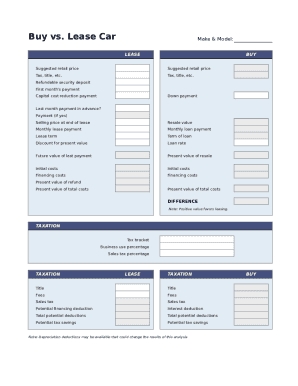

The Buy Vs Lease Car Calculator is an essential tool for individuals considering their car financing options. This guide will provide you with comprehensive, step-by-step instructions on how to complete the form online, ensuring you can make an informed decision.

Follow the steps to fill out the Buy Vs Lease Car Calculator efficiently.

- Click the ‘Get Form’ button to access the form and open it for input.

- Begin by entering the make and model of the vehicle you are considering. This will help tailor the calculator to your specific choice.

- Input the suggested retail price of the car. Ensure this is the current market price for accuracy.

- Fill in the tax, title, and other fees associated with the purchase or lease of the vehicle.

- For leasing, enter the refundable security deposit, first month's payment, and any capital cost reduction payments. For buying, input the down payment and last month's payment if made in advance.

- Indicate the selling price at the end of the lease if you choose this option, or the anticipated resale value if you are buying.

- Enter the monthly lease payment or the monthly loan payment based on your selected financing option.

- Specify the lease term or the term of loan as applicable, along with the loan rate and any applicable discounts for present value.

- Include financing costs and initial costs for both options to ensure an accurate comparison between buying and leasing.

- Complete the sections regarding taxation by entering your tax bracket, business use percentage, and sales tax percentage.

- Finalize your entries by reviewing all provided information for accuracy before proceeding. Users can save changes, download, print, or share the completed form as needed.

Begin comparing your car financing options today by filling out the Buy Vs Lease Car Calculator online.

Monthly payments on a bank loan are normally higher than Leasing. Leasing can often have lower monthly payments depending on the mileage and term you choose, but you won't own the vehicle at the end of the term. ... When buying a new vehicle normally half its value may be lost within the first 3 years.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.