Loading

Get Loan Application Template

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Loan Application Template online

Filling out a loan application online can be a straightforward process when guided correctly. This guide will provide you with the necessary steps to complete the Loan Application Template efficiently and accurately.

Follow the steps to complete your loan application.

- Click ‘Get Form’ button to access the loan application template and open it in your preferred editor.

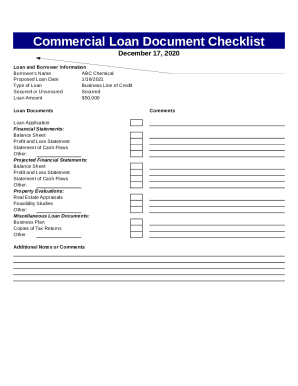

- Begin by entering the borrower's name in the designated field. Ensure that the name matches the legal entity applying for the loan, such as ABC Chemical.

- Input the proposed loan date in the appropriate field. This should reflect the intended date for loan acquisition, which is set for 1/16/2021.

- Select the type of loan from the provided options. For this application, you will indicate that it is a business line of credit.

- Specify whether the loan is secured or unsecured. For this application, you will choose ‘Secured’.

- Enter the desired loan amount in the respective field. In this case, you will input $50,000.

- Gather and attach required financial documents, including your balance sheet, profit and loss statement, and statement of cash flows in the designated sections.

- Include projected financial statements in the next section, ensuring to provide a projected balance sheet, profit and loss statement, and statement of cash flows.

- Complete the property evaluations section by adding real estate appraisals and feasibility studies, along with any other relevant evaluations.

- Provide miscellaneous loan documents, which may include your business plan and copies of tax returns. Ensure that all related documents are included.

- Use the additional notes or comments section to provide any other important information that may support your application.

- After completing all sections, review your entered information for accuracy. Once you are satisfied, save your changes, and you can download, print, or share the completed application as required.

Start filling out your loan application online today!

Key Takeaways. Mortgage lenders verify employment by contacting employers directly and requesting income information and related documentation. Most lenders only require verbal confirmation, but some will seek email or fax verification.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.