Loading

Get Deferred Tax Rate Calculator

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Deferred Tax Rate Calculator online

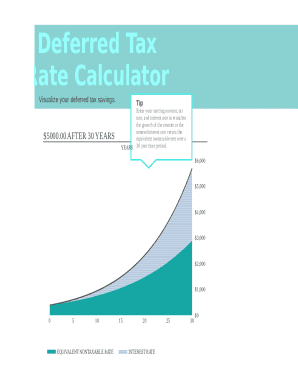

The Deferred Tax Rate Calculator is a valuable tool designed to help users visualize their potential deferred tax savings over time. This guide provides clear instructions on how to effectively complete the calculator to understand the impact of different tax and interest rates.

Follow the steps to successfully fill out the calculator.

- Click ‘Get Form’ button to access the Deferred Tax Rate Calculator form and open it for editing.

- Enter your starting amount in the designated field. This is the initial sum you wish to evaluate for deferred tax savings.

- Input your anticipated tax rate in the provided section. This rate will help determine the taxable impact on your investment over time.

- Enter your expected interest rate in the relevant field. This rate will be used to visualize the growth of the initial amount over the specified period.

- Specify the time period for which you want to visualize your tax savings by entering '30' in the years section, indicating a 30-year timeframe.

- Review all entered information for clarity and accuracy to ensure the calculations reflect correct values.

- After completing the form, you can save your changes, download the results, print them for your records, or share the calculator output as needed.

Start filling out the Deferred Tax Rate Calculator online today to understand your tax savings potential.

Deferred income tax shows up as a liability on the balance sheet. The difference in depreciation methods used by the IRS and GAAP is the most common cause of deferred income tax. Deferred income tax can be classified as either a current or long-term liability.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.