Loading

Get Estimate Of Tax Liability

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Estimate Of Tax Liability online

The Estimate Of Tax Liability form is an essential document for individuals to estimate their tax obligations for the year. Accurately completing this form helps ensure proper tax planning and compliance with governmental regulations.

Follow the steps to complete the Estimate Of Tax Liability form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

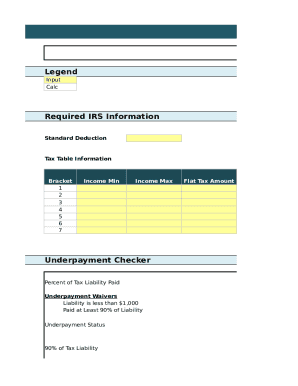

- Begin filling out the 'Required IRS Information' section. Here, you will input your total salary earnings, deductions, and any other income sources. Ensure accuracy to avoid future discrepancies.

- Calculate your 'Taxable Salary Earnings' by subtracting total deductions from your total salary earnings. This figure is crucial for determining your tax bracket.

- In the 'Tax Table Information' section, reference the tax brackets to determine your applicable tax rate based on your taxable salary earnings.

- Next, fill out the 'Investment Income' and 'Additional Income' fields. Include any other income sources to provide a complete picture of your financial situation.

- Proceed to calculate your 'Gross Taxable Income' by adding your 'Taxable Salary Earnings,' 'Investment Income,' and 'Other Income'.

- Input your 'Standard Deduction' to adjust your taxable income. This deduction reduces your overall income and is an important factor in estimating tax liability.

- Finalize the section of 'Adjusted Taxable Income' by subtracting the standard deduction from your gross taxable income.

- Proceed to the 'Tax Bracket' area to identify your applicable tax bracket percentage based on the adjusted taxable income.

- Calculate your 'Total Tax Liability' using the relevant tax bracket and your adjusted taxable income.

- Lastly, review your entries carefully, ensuring all fields are filled out correctly. Once verified, you can choose to save changes, download, print, or share the form.

Complete the Estimate Of Tax Liability form online today to ensure accurate tax planning and compliance.

How to Estimate Your Tax Liability Review last year's tax return. ... Estimate tax liability. ... Determine how much has been withheld so far. ... Subtract the withheld taxes from your projected tax bill. ... Divide the amount you still owe by your remaining pay periods. ... To make changes, complete a new Form W-4.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.