Loading

Get Depreciation Calculation Sheet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Depreciation Calculation Sheet online

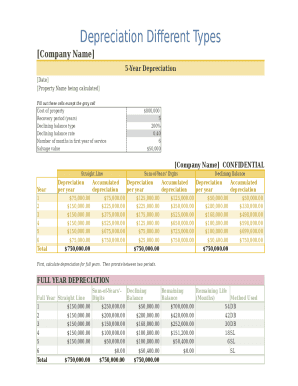

The Depreciation Calculation Sheet is an essential tool for calculating the depreciation of property over selected recovery periods. This guide will lead you through each section of the form, ensuring a thorough understanding of how to complete it effectively online.

Follow the steps to fill out the Depreciation Calculation Sheet with ease.

- Click the ‘Get Form’ button to obtain the Depreciation Calculation Sheet and open it in your preferred online editor.

- Begin by entering the cost of the property in the designated cell. This figure serves as the starting point for your calculations.

- Fill out the annual depreciation and accumulated depreciation for each year based on the methods specified (Straight Line, Sum-of-Years' Digits, Declining Balance).

- Make sure to review all entries for accuracy. If necessary, adjust any figures to reflect accurate calculations.

- Once you have entered all the necessary information, you can save your changes, download the completed form, print it, or share it as needed.

Start filling out your Depreciation Calculation Sheet online today for accurate financial reporting.

Related links form

Subtract the asset's salvage value from its cost to determine the amount that can be depreciated. Divide this amount by the number of years in the asset's useful lifespan. Divide by 12 to tell you the monthly depreciation for the asset.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.