Loading

Get Canada T2011 2019-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T2011 online

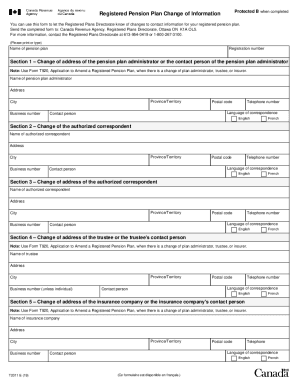

The Canada T2011 form is essential for notifying the Registered Plans Directorate of any changes to contact information concerning your registered pension plan. This guide provides a clear, step-by-step approach to help you accurately complete the form online.

Follow the steps to complete the Canada T2011 form online.

- Click ‘Get Form’ button to access the form and open it in your online editor.

- Fill in the name of the pension plan and its registration number at the top of the form.

- Proceed to Section 1 to update the contact information of the pension plan administrator, including their name, address, province/territory, city, business number, postal code, and telephone number.

- Indicate the preferred language of correspondence (English or French) and the name of the contact person for the administrator.

- Move to Section 2 to provide details for the authorized correspondent, including their name, address, province/territory, city, business number, postal code, telephone number, and language preference.

- In Section 3, update the address of the authorized correspondent, if applicable, by repeating the relevant fields.

- In Section 4, enter the name and address details for the trustee or the trustee's contact person, including all necessary identifiers similar to previous sections.

- For Section 5, provide the name and contact information for the insurance company or its contact person, ensuring all required fields are appropriately filled.

- In Section 6, an authorized representative must certify the accuracy of the information provided by entering their name, date, signature, and telephone number.

- Review the completed form for accuracy, then save your changes. You can now download, print, or share the form as needed.

Complete your forms online efficiently and accurately today.

Your notice of assessment (NOA) is an evaluation of your tax return that the Canada Revenue Agency sends you every year after you file your tax return. Your NOA includes the date we checked your tax return, and the details about how much you may owe, or get as a refund or credit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.