Loading

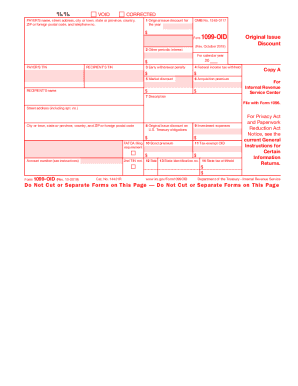

Get Irs 1099-oid 2019-2026

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1099-OID online

Filling out the IRS 1099-OID form online can be a straightforward process when you know what to do. This guide is designed to provide you with clear instructions to help you accurately complete the form with ease.

Follow the steps to fill out the IRS 1099-OID online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide the payer's name and address. Enter the street address, city or town, state or province, country, ZIP or foreign postal code, and the payer's telephone number.

- Enter the payer's Tax Identification Number (TIN). Also, fill in the recipient's TIN and name.

- Complete Box 1 by entering the total original issue discount amount for the year.

- If applicable, fill in Box 2 with other periodic interest received.

- If any early withdrawal penalties apply, enter the amount in Box 3.

- In Box 4, record any federal income tax withheld.

- Complete Boxes 5 and 6 for market discount and acquisition premium if applicable.

- In Box 7, provide a description or identification number for the obligation.

- If applicable, fill in Box 8 for original issue discount on U.S. Treasury obligations.

- Fill out Boxes 9 through 14 as necessary for investment expenses, tax-exempt OID, state income details, and any state tax withheld.

- Review the completed form for accuracy before saving your changes.

- Once finished, download and print or share the completed form as needed.

Begin filling out your IRS 1099-OID form online today.

What Is Form 1099-OID? Form 1099-OID, "Original Issue Discount," is the IRS form that you received if you must include an amount of OID in your taxable income. OID is the excess of an obligation's stated redemption price at maturity over its issue price, and it is taxable as interest over the life of the obligation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.