Loading

Get Irs 4835 2020

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 4835 online

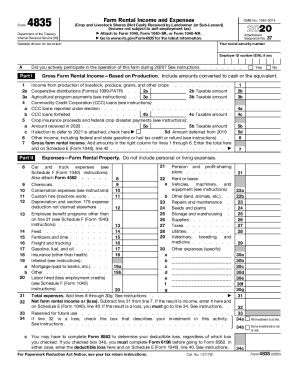

Filling out the IRS Form 4835 is essential for reporting farm rental income and expenses when you are a landowner who did not materially participate in the farm's operation. This guide provides clear, step-by-step instructions to ensure accurate and efficient completion of the form online.

Follow the steps to complete IRS Form 4835 online.

- Use the 'Get Form' button to access the IRS Form 4835 and open it in your preferred editor.

- Begin by entering your social security number and the name(s) as shown on your tax return. If applicable, include your employer ID number (EIN).

- Indicate if you actively participated in the operation of the farm during the year by selecting 'Yes' or 'No' as applicable.

- In Part I, report your gross farm rental income, including livestock and crops. Complete lines 1 through 6 based on the income received during the year.

- In Part II, record your expenses associated with the farm rental property. Complete lines 8 through 30g by entering the relevant expenses incurred.

- Calculate your total expenses on line 31 and find the net farm rental income or loss by subtracting total expenses from gross income on line 32.

- If applicable, complete additional questions regarding your investment risk on lines 34a through 34c.

- Review all entered information for accuracy and completeness. Ensure you follow all instructions before finalizing.

- Finally, save your changes, download a copy of the form, and print or share it as needed.

Complete your documents online and ensure compliance with IRS requirements.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Use Schedule F (Form 1040) to report farm income and expenses. File it with Form 1040, 1040-SR, 1040-NR, 1041, or 1065. Your farming activity may subject you to state and local taxes and other require- ments such as business licenses and fees.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.