Loading

Get Irs 8879 2021-2026

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8879 online

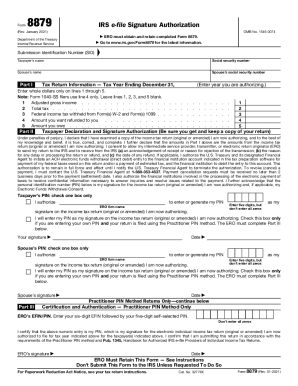

Filling out the IRS 8879 form is a crucial step in authorizing the electronic filing of your tax return. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the IRS 8879 form online

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- At the top of the form, enter the taxpayer's name and social security number. If applicable, also provide the spouse's name and social security number.

- In Part I titled 'Tax Return Information', fill in the appropriate lines with the tax return details including your adjusted gross income, total tax, federal income tax withheld, any desired refund amount, and owed amount. Ensure you only enter whole dollars.

- In Part II, based on the level of authorization you are providing, indicate whether the ERO is authorized to enter or generate your PIN or if you will enter it yourself. Provide the year you are authorizing.

- Sign and date the form in the Taxpayer Declaration section. Remember that your signature and the PIN provided are essential for the electronic return.

- If applicable, have the spouse sign and enter their PIN using a similar method as described above.

- Complete Part III only if you are using the Practitioner PIN method. Here, the ERO will enter their EFIN and PIN.

- Review your entries for accuracy, then save changes to the form. You can download, print, or share the completed form as needed.

Start completing your documents online today!

Form 8879 is the declaration document and signature authorization for an e-filed return filed by an electronic return originator (ERO). Complete this form when: The Practitioner PIN method is used.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.