Loading

Get Ed Public Service Loan Forgiveness (pslf) & Temporary Expanded Pslf (tepslf) Certification &

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ED Public Service Loan Forgiveness (PSLF) & Temporary Expanded PSLF (TEPSLF) Certification & online

This guide provides detailed instructions on how to accurately complete the ED Public Service Loan Forgiveness (PSLF) & Temporary Expanded PSLF (TEPSLF) Certification & form online. By following these steps, users can ensure their application is filled out correctly and efficiently.

Follow the steps to complete the form successfully.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred editor.

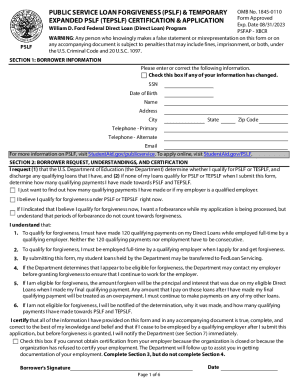

- In Section 1, input or correct your borrower information. This includes your Social Security Number, date of birth, name, address, city, state, zip code, primary and alternate telephone numbers, and email. If any of this information has changed, check the designated box.

- Move to Section 2 to indicate your requests and understandings regarding PSLF or TEPSLF. Choose the appropriate response that reflects your current eligibility and whether you wish to apply for forbearance while your application is processed.

- Enter Section 3, where you or your employer will provide employer information. Fill out the employer's name, Federal Employer Identification Number, and address. Additionally, indicate the employment status (full-time or part-time) and the average hours worked per week.

- In Section 4, your employer will need to certify the information provided in Section 3. They must sign and complete the official’s details including name, phone number, title, email, and date.

- Review the instructions provided in Section 5 to ensure you are entering data correctly. Dates should be formatted as month-day-year (mm-dd-yyyy), and all information should be filled in with dark ink or typed clearly.

- If necessary, proceed to Section 6 to understand the definitions of qualifying payments, loan eligibility, and employment requirements related to PSLF or TEPSLF.

- Upon completion, refer to Section 7 to determine where to submit your completed form. This includes options for mailing, faxing, or uploading the document.

- In the final step, ensure you have saved all changes made to the form. After verifying the information is correct, you can download, print, or share the completed form as needed.

Start filling out your ED PSLF & TEPSLF Certification & online to ensure you receive the benefits you may qualify for.

Related links form

Eligible Loans Any loan received under the William D. Ford Federal Direct Loan (Direct Loan) Program qualifies for PSLF. Loans from these federal student loan programs don't qualify for PSLF: the Federal Family Education Loan (FFEL) Program and the Federal Perkins Loan (Perkins Loan) Program.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.