Loading

Get Irs 8995 2020-2026

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8995 online

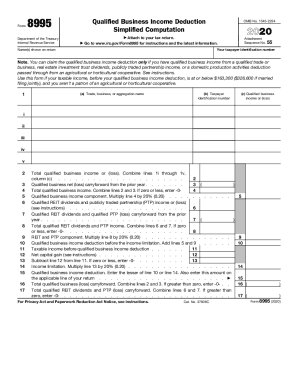

Filing the IRS Form 8995 is essential for claiming the qualified business income deduction. This guide provides step-by-step instructions to help users fill out the form accurately and confidently, ensuring they understand each section.

Follow the steps to complete the IRS 8995 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your taxpayer identification number in the designated field. This is crucial for proper identification and processing of your tax return.

- Fill in the name(s) shown on the return. Make sure the names match what is on your tax documents to avoid any discrepancies.

- Complete section 1 by providing information about your trade, business, or aggregation name, and input your taxpayer identification number along with your qualified business income or (loss) in lines 1a, 1b, and 1c.

- In line 2, combine all qualified business income or (loss) amounts from section 1 and enter the total.

- If you have any carryforwards from the previous year, input that information in line 3.

- Calculate your total qualified business income by completing line 4, adding the amounts from line 2 and line 3, with appropriate attention to negative results.

- Proceed to line 5 where you will calculate the qualified business income component by multiplying line 4 by 20%.

- Fill out lines 5 through 9, reporting any qualified REIT dividends and PTP income or (loss), as well as their carryforwards, and calculating totals as instructed.

- After you have completed the necessary calculations, enter the final deduction amount in line 14, while ensuring it does not exceed prescribed limits, and appropriately transfer this amount to your tax return.

- Finally, review the entire form for accuracy, save your changes, and consider downloading or printing a copy for your records.

Complete your IRS 8995 form online to ensure your qualified business income deduction is accurately claimed.

Related links form

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.