Loading

Get Canada 5000-s1 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada 5000-S1 online

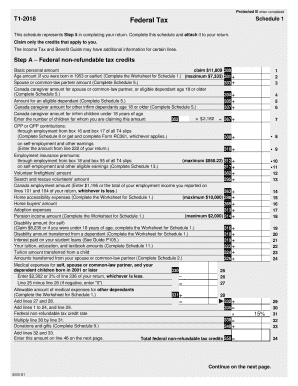

The Canada 5000-S1 form is an essential component of your federal tax return. This guide provides comprehensive and user-friendly instructions to help you fill it out correctly online.

Follow the steps to accurately complete the Canada 5000-S1 form.

- Click ‘Get Form’ button to access the Canada 5000-S1 form and open it in your preferred online document editor.

- Begin with Step A – Federal non-refundable tax credits. Enter the basic personal amount of $11,809 in the designated field.

- If applicable, fill in any additional credits such as the age amount for those born in 1953 or earlier, using the provided worksheet for assistance.

- Complete the amounts for your spouse or common-law partner, if relevant. You will need to reference Schedule 5 for these calculations.

- Continue filling in credits for any eligible dependants and other amounts, ensuring to complete related worksheets as required.

- Once all the applicable fields are filled in Step A, proceed to Step B – Federal tax on taxable income. Input your taxable income from line 260 of your return.

- Determine your federal tax rate based on the income brackets provided. Carefully multiply the amounts as indicated for accurate calculations.

- For Step C – Net federal tax, sum the totals from previous calculations and ensure all applicable credits are added.

- Finally, review all entries and confirm accuracy. Save your changes, and you may then choose to download, print, or share the completed form.

Start filling out your Canada 5000-S1 form online today to ensure accurate submission.

The Canada Revenue Agency's goal is to send your refund within: 2 weeks, when you file online. 8 weeks, when you file a paper return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.