Loading

Get Irs 14452 2014-2025

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 14452 online

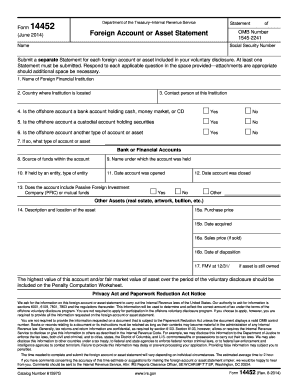

The IRS 14452 form, officially known as the Foreign Account or Asset Statement, is essential for individuals seeking to disclose foreign financial accounts and assets under the offshore voluntary disclosure program. This guide will walk you through the process of completing this form online effectively and efficiently.

Follow the steps to fill out the IRS 14452 online:

- Press the ‘Get Form’ button to access the IRS 14452 form and open it in your preferred editor.

- In the first section, provide your name and social security number accurately. This information is critical for identification purposes.

- Complete a separate statement for each foreign account or asset you are disclosing. Ensure at least one statement is submitted.

- In the next fields, detail the name of the foreign financial institution and the country where it is located.

- Identify a contact person at this institution, if applicable, to provide additional assistance or verification.

- Indicate whether the offshore account is a bank account holding cash, a money market account, or a certificate of deposit by choosing 'Yes' or 'No'.

- Similarly, specify if the offshore account is a custodial account holding securities by responding with 'Yes' or 'No'.

- If the account type is different, indicate that it is another type of account or asset and describe its nature.

- Provide the source of funds held within the account.

- Enter the name under which the account was maintained.

- If the account was held by an entity, specify the type of entity.

- Fill in the date on which the account was opened and, if applicable, the date it was closed.

- For accounts including Passive Foreign Investment Companies or mutual funds, respond accordingly.

- For other assets such as real estate or artwork, give a detailed description and location of the asset.

- Enter the purchase price and the date you acquired the asset.

- If the asset has been sold, provide the sales price and the date of disposition.

- Indicate the fair market value at the end of the specified date if the asset is still owned.

- Review all entered information for accuracy and completeness. Save your changes.

- Finally, download, print, or share the completed form as necessary for your records.

Begin completing the IRS 14452 online to ensure your foreign accounts and assets are properly disclosed.

Because of that, Americans that purchase real U.S. interest property from a resident alien will not have to withhold FIRPTA taxes. Remember, to be considered a foreign person under FIRPTA, a transferor cannot be American or be a resident of the United States.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.