Loading

Get Online Inheritance Tax Consent To Transfer Application - Tn.gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Online Inheritance Tax Consent To Transfer Application - TN.gov online

Navigating the process of completing the Online Inheritance Tax Consent To Transfer Application can be straightforward if you follow the right steps. This guide provides a clear and supportive approach to help you successfully fill out the form, ensuring all required information is accurately submitted.

Follow the steps to complete your application effectively.

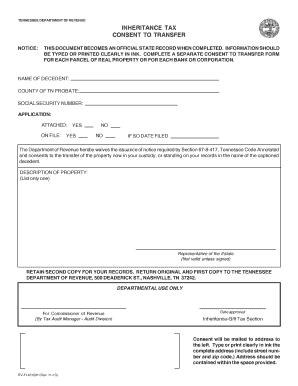

- Press the ‘Get Form’ button to access the form and open it for completion.

- Begin the form by entering the name of the decedent. This should be recorded clearly to avoid any errors in processing.

- Next, indicate the county of Tennessee where the probate is taking place. This is vital for identifying jurisdiction.

- Provide the social security number of the decedent. Ensure this information is accurate to facilitate proper identification.

- In the application section, specify whether the following documents are attached or on file. Select 'Yes' or 'No' accordingly.

- Describe the property that is subject to transfer. Note that you should list only one property per form.

- Ensure a representative of the estate signs the form. This step is crucial for validating the document.

- Keep a second copy of the completed form for your records. Return the original and the first copy to the Tennessee Department of Revenue at the specified address.

- After finalizing all fields, review your entries for accuracy before proceeding to save changes, download, print, or share the form as needed.

Begin completing your Online Inheritance Tax Consent To Transfer Application now to ensure a seamless transfer process.

Here are the states where you won't have to pay separate estate or inheritance taxes: Alabama. Alaska. Arizona. Arkansas. California. Colorado. Delaware. Florida.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.