Loading

Get Kw5

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KW-5 online

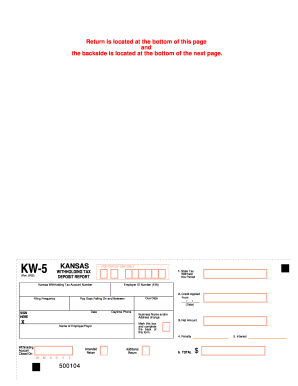

The KW-5 form is used for reporting the Kansas income tax withheld from wages and other taxable payments. This guide provides a step-by-step approach to help users navigate the process of filling out the form online with confidence.

Follow the steps to complete the KW-5 form efficiently

- Click the ‘Get Form’ button to obtain the KW-5 form and open it in your chosen editor.

- Enter your Kansas withholding tax account number in the designated field.

- Input your employer ID number (EIN) as required.

- Provide the filing frequency that applies to your reporting.

- Mark the due date for your tax deposit in the appropriate section.

- Indicate the paydays falling within the reporting period by entering the relevant dates.

- On line 1, enter the amount of state tax withheld for the period. If no amount is withheld, enter '0' and sign the form.

- For line 2, input any credits from prior periods and the date this credit was generated.

- Calculate the net amount by subtracting line 2 from line 1 and enter the result on line 3.

- Complete line 4 by indicating any penalties that apply if the report is filed late.

- Enter any interest that may apply on line 5 if filing after the due date.

- Add lines 3, 4, and 5 together and write the total on line 6.

- Sign the document, include your daytime phone number, and ensure all information is correct.

- Make remittance payable to 'Kansas Withholding Tax' and send it to the specified address.

- Check if there are any changes to your business name or address, and if so, mark the appropriate box and provide the new information on the back of the form.

- For any additional withholding or amended returns, ensure that you use a blank KW-5 and mark the applicable box.

- Finalize the process by saving your changes, and consider downloading or printing the completed form for your records.

Start filling out your KW-5 form online today for a smooth filing experience.

Complete the Notice of Business Closure (CR-108) Return the completed form to: Kansas Department of Revenue, PO Box 3506, Topeka, KS 66625-3506 or FAX to 785-291-3614. Include information on the date the business was closed. Make sure all tax filings are current.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.