Loading

Get Debit Credit Fill In Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Debit Credit Fill In Form online

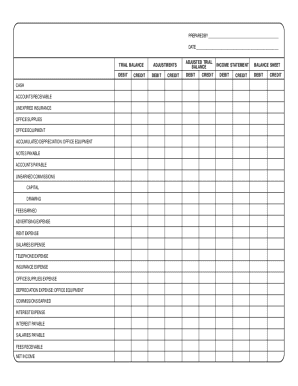

Filling out the Debit Credit Fill In Form online can be a straightforward process if you follow the right steps. This guide will help you navigate through each section of the form, ensuring that you understand what is required for accurate completion.

Follow the steps to effectively complete the form.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Begin by filling out the date at the top of the form where indicated. This helps in identifying the timeframe for the financial entries.

- In the section for cash, accounts receivable, unexpired insurance, and office supplies, enter the relevant amounts in the 'Debit' column as these are asset entries.

- For liabilities such as notes payable and accounts payable, enter the applicable amounts in the 'Credit' column. These entries represent the amounts owed by the business.

- Input the income and expense figures, beginning with fees earned in the income section and various expense categories. Use the corresponding debit and credit columns as appropriate.

- Complete the income statement and balance sheet sections by recording any additional adjustments or calculations identified while working on your entries.

- After accurately filling in all the sections, review the form for completeness and accuracy.

- Finally, you can save your changes, download, print, or share the completed form as needed.

Begin filling out your document online today for seamless financial management.

For example, you would debit the purchase of a new computer by entering the asset gained on the left side of your asset account. A credit is an entry made on the right side of an account. It either increases equity, liability, or revenue accounts or decreases an asset or expense account.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.