Loading

Get Rc4288

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rc4288 online

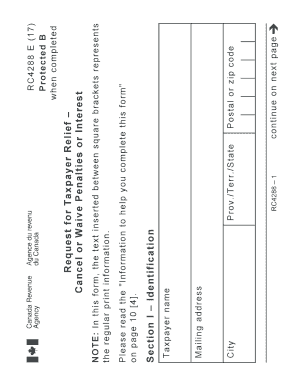

Filling out the Rc4288 form online is a crucial step for individuals seeking to request relief from penalties or interest imposed by the Canada Revenue Agency. This guide provides clear and detailed instructions to navigate each section of the form effectively.

Follow the steps to complete the Rc4288 form with ease.

- Click ‘Get Form’ button to access the Rc4288 form and open it in your preferred editor.

- Fill in your identification details in Section I. This includes your taxpayer name, mailing address, province, postal code, and social insurance number.

- In Section 2, provide the details of your request. Specify the type of penalty or interest and the amounts, if known. Include any relevant account numbers and the reasons for your request.

- Indicate any circumstances related to your request, such as financial hardship or delays caused by the Canada Revenue Agency. Provide specific years or periods involved.

- Section 3 requires you to support your request with documentation. Attach any relevant documents, including correspondence from the Canada Revenue Agency.

- If applicable, complete Section 4 for certification. Provide your signature and the necessary information about your representative, if you have one.

- Finally, submit the completed form and all supporting documentation to the designated office based on your province or territory of residence for processing.

Complete your Rc4288 form online today for a smoother application process.

The CRA will also charge you interest on both the balance owing and any penalty. The penalty is 5% of any balance owing, plus 1% of the balance owing for each full month that the return is late, to a maximum of 12 months.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.