Loading

Get Commonwealth Of Puerto Rico Form 2907 Fillable

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Commonwealth Of Puerto Rico Form 2907 Fillable online

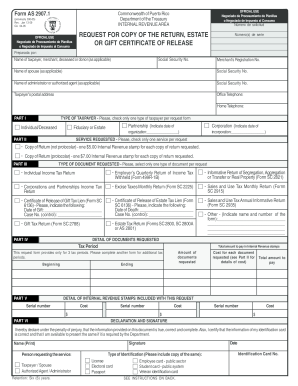

The Commonwealth Of Puerto Rico Form 2907 Fillable is designed for users seeking to obtain copies of tax returns or certificates related to estates or gifts. This guide provides step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to fill out the form online

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- Begin by entering the request number in the designated field, which is essential for processing your request.

- Fill in the relevant social security numbers for all involved parties, including the taxpayer, spouse, and authorized agent, if applicable.

- Provide the names of the taxpayer, merchant, deceased individual, or donor, as necessary, along with the merchant’s registration number if applicable.

- Complete the taxpayer’s postal address and contact information, including both office and home telephone numbers.

- In Part I, check the box that corresponds to the type of taxpayer making the request, choosing from options like Individual/Deceased or Fiduciary or Estate.

- In Part II, select the service you are requesting. Make sure to indicate if you want a copy of the return or certificate. Remember to account for the costs associated with each type of request.

- In Part III, choose the specific type of document you are requesting by marking the appropriate box.

- Detail the tax periods for which you are requesting documents in Part IV, ensuring that you complete the information for each document requested.

- If necessary, indicate in Part V any other documents required and their associated costs.

- In Part VI, understand the declaration and signature section. Sign and print your name, confirming the truthfulness of the information provided.

- After completing the form, review all entries for accuracy. Users can then save the completed document, download, print, or share as needed.

Take action today by completing the Commonwealth Of Puerto Rico Form 2907 Fillable online.

You must file a Puerto Rico tax return reporting income from Puerto Rico sources, and a U.S. tax return reporting income from worldwide sources. A foreign tax credit is available for taxes paid to Puerto Rico on income that is not exempt on the U.S. tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.