Get Mi Mutual Regz–til 2011-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI Mutual REGZ–TIL online

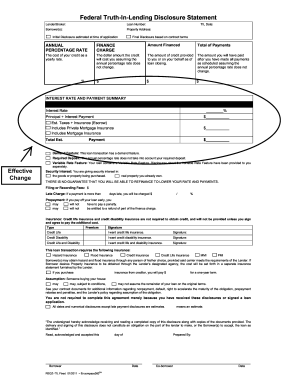

This guide provides clear and detailed instructions for users on how to complete the MI Mutual REGZ–TIL online form accurately. Each section will be broken down step-by-step to ensure that even those unfamiliar with legal documents can navigate with confidence.

Follow the steps to complete the MI Mutual REGZ–TIL form successfully.

- Click ‘Get Form’ button to obtain the MI Mutual REGZ–TIL form and open it in your preferred editor.

- Fill in the 'Lender/Broker' section with the name of the lender or broker providing the loan.

- Enter the 'Loan Number' assigned to your specific loan application.

- Provide the names of the 'Borrower(s)' involved in the loan agreement.

- Add the 'Property Address' where the loaned property is located.

- Specify the 'TIL Date' for the initial disclosure and ensure it aligns with the date of application.

- Complete the sections for 'Annual Percentage Rate,' 'Finance Charge,' 'Amount Financed,' and 'Total of Payments' using the appropriate figures from your loan agreement.

- In the 'Interest Rate and Payment Summary,' input the current interest rate and the estimated principal and interest payment amount.

- Detail any required deposits or variable rate features as highlighted in your loan documentation.

- Review the 'Security Interest' section to outline the property or goods secured by the loan.

- If applicable, enter information regarding late charges, prepayment penalties, and insurance requirements.

- Review the section on assumptions for potential future buyers of the property.

- Finally, ensure all fields are filled correctly, then save your changes, download, print, or share the completed form as needed.

Complete your MI Mutual REGZ–TIL form online today to stay organized and on track.

Managing all your mutual funds in one place is made easier with platforms like uslegalforms. This service allows you to consolidate your investments, providing you with a clear overview of your MI Mutual REGZ–TIL holdings. By keeping your funds organized, you can make more informed decisions about your portfolio and streamline your investment process. Plus, this makes it simpler to track your growth and manage your timelines.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.