Loading

Get Mi Form 2766 L-4260 2009-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI form 2766 L-4260 online

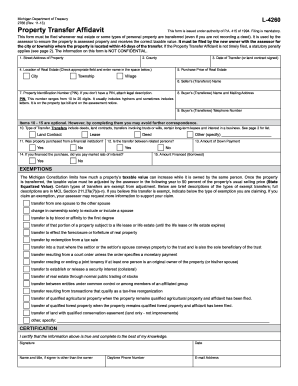

Filling out the MI form 2766 L-4260 online is essential when transferring ownership of real estate or certain types of personal property in Michigan. This guide will provide detailed, step-by-step instructions to help users navigate the form with ease.

Follow the steps to complete the MI form 2766 L-4260 online

- Press the ‘Get Form’ button to obtain the form and access it within the editor.

- Enter the street address of the property being transferred in the designated field.

- Select the county where the property is located from the dropdown menu.

- Input the date of the transfer or the date the land contract was signed.

- Indicate the location of the real estate by checking the appropriate field (City, Township, or Village) and providing the name below.

- Fill in the purchase price of the real estate.

- Enter the seller’s (transferor) name accurately.

- Provide the Property Identification Number (PIN). If not available, attach a legal description.

- Input the buyer’s (transferee) name and mailing address.

- Enter the buyer’s (transferee) telephone number.

- Select the type of transfer: Deed, Land Contract, Lease, or other as specified.

- Indicate if the property was purchased from a financial institution.

- Specify if the transfer is between related persons.

- Fill in the amount of down payment provided for the purchase.

- Indicate the amount financed (borrowed) for the property purchase.

- If applicable, specify the type of exemption claimed for the transfer.

- Review all entered information for accuracy.

- Finalize the form by signing, providing your name, title (if applicable), date, and contact information.

- Save changes to your form, and then select options to download, print, or share the completed document.

Complete your MI form 2766 L-4260 online today to ensure timely submission and compliance.

The employee's withholding certificate is completed by the employee themselves. This form is essential for employers to determine the appropriate amount of federal income tax to withhold from an employee's paycheck. It is crucial for employees to provide accurate information to avoid under-withholding or over-withholding. For detailed instructions, refer to the MI form 2766 L-4260.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.