Loading

Get 12dd

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 12dd online

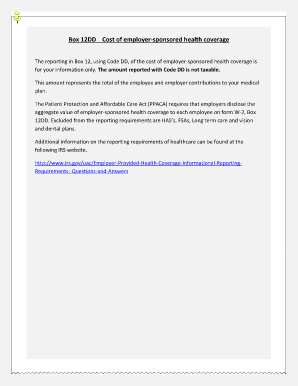

This guide provides a clear and supportive approach to filling out the 12dd form online. Understanding how to accurately report the cost of employer-sponsored health coverage is essential for both employees and employers.

Follow the steps to fill out the 12dd form accurately.

- Click the ‘Get Form’ button to access the 12dd form and open it in an editable format.

- Locate the section designated for reporting in Box 12. You will need to find the area that specifically mentions the employer-sponsored health coverage.

- Enter the total amount that represents both employee and employer contributions to your medical plan. Ensure that this value reflects the aggregate cost accurately.

- Verify that you are not including amounts related to Health Savings Accounts (HSAs), Flexible Spending Accounts (FSAs), long-term care, vision, or dental plans, as these are excluded from the reporting requirements.

- Review all entered information for accuracy. It is important that the details provided are correct, as this will be used for informational purposes on form W-2.

- Once you have completed all required sections, you can save the changes, download a copy of the form, print it for your records, or share it as necessary.

Complete your documents online today for a seamless experience.

D : Contributions to your 401(k) plan. DD: Cost of employer-sponsored health coverage. More info. E: Contributions to your 403(b) plan. EE: Designated Roth contributions under a governmental section 457(b) plan.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.