Loading

Get Irs 8992 2020

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8992 online

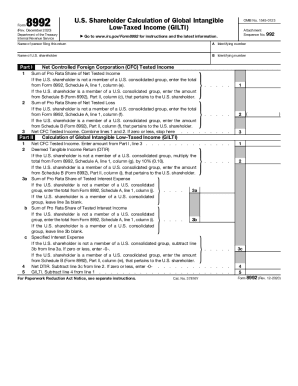

Filling out IRS Form 8992 can be a complex task, but this guide aims to simplify the process for you. This form is essential for U.S. shareholders calculating their global intangible low-taxed income (GILTI). Follow these detailed instructions to complete the form accurately.

Follow the steps to successfully complete Form 8992 online.

- Press the ‘Get Form’ button to access and open the form in your preferred digital editor.

- In the first section, identify the name and identifying number of the person filing the return, followed by the name and identifying number of the U.S. shareholder.

- Proceed to Part I. For lines 1 and 2, enter the sum of the pro rata share of net tested income or losses depending on whether the U.S. shareholder is part of a consolidated group.

- On line 3, combine lines 1 and 2 to calculate net CFC tested income. If this amount is zero or less, you have completed that section.

- Move to Part II. Input the net CFC tested income from Part I, line 3 on line 1. Enter deemed tangible income return (DTIR) based on whether you belong to a consolidated group.

- For lines 3a and 3b, fill in the pro rata share of tested interest expense and income based on whether you are part of a consolidated group or leave them blank if applicable.

- Calculate specified interest expense on line 3c and, if applicable, input the amount from Schedule B pertaining to the U.S. shareholder.

- Continue by calculating net DTIR on line 4, followed by GILTI on line 5 by subtracting line 4 from line 1.

- Once you have completed all required fields, review your entries for accuracy. Save your changes, and you can choose to download, print, or share the form as necessary.

Start filling out your IRS 8992 online today to ensure accurate reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

GILTI is calculated as the total active income earned by a US firm's foreign affiliates that exceeds 10 percent of the firm's depreciable tangible property.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.