Loading

Get Ph Bir 1903 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PH BIR 1903 online

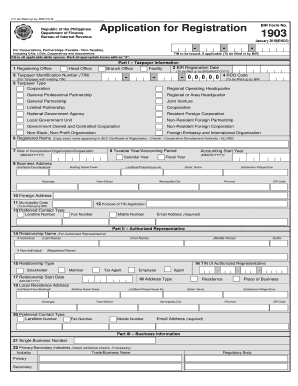

The PH BIR 1903 form is essential for various entities seeking to register with the Bureau of Internal Revenue in the Philippines. This guide provides clear and systematic instructions for users to fill out the form online, ensuring a smooth registration process.

Follow the steps to successfully complete the PH BIR 1903 form.

- Click the ‘Get Form’ button to obtain the form and open it for online editing.

- Begin completing Part I – Taxpayer Information. Start with the 'Registering Office' by indicating whether it is a branch office or head office. Ensure to fill in the tax identification number (TIN) if applicable.

- Fill in the 'BIR Registration Date' in MM/DD/YYYY format. If you do not have a pre-existing TIN, leave that section blank as it is for the Bureau of Internal Revenue to complete.

- Select the 'Taxpayer Type' from the available options, marking the appropriate box with an 'X'. This includes, but is not limited to, corporation, general professional partnership, cooperative, and various government entities.

- Provide the 'Registered Name' exactly as it appears in the SEC Certificate of Registration or relevant charter documents.

- Indicate the 'Date of Incorporation/Organization/Cooperation'. This should also be in MM/DD/YYYY format.

- Select your 'Taxable Year/Accounting Period' and specify if it is a calendar or fiscal year.

- Enter the complete 'Business Address', including all necessary fields such as building name, street name, municipality/city, and ZIP code.

- If applicable, fill in your 'Foreign Address'. You may also specify the 'Purpose of TIN Application' as required in the form.

- Complete the 'Preferred Contact Type' section with your preferred method of communication, including email, which is mandatory.

- Move on to Part II - Authorized Representative. Provide the relationship and name details of the authorized representative. Clearly indicate their TIN if available.

- Complete the local residence address and preferred contact details for the authorized representative.

- In Part III – Business Information, provide your single business number and primary/secondary industries. Be sure to include any relevant licenses or regulatory details.

- For facilities, accurately fill out Part IV with the facility code and details, ensuring you choose the correct type.

- Address the various tax types in Part V. Check all applicable taxes that relate to your business operations.

- In Part VI, fill in the 'Authority to Print Receipts and Invoices' section by providing the printer’s details.

- Proceed to Part VII and list all stockholders, partners, or members involved, ensuring to attach additional sheets if necessary.

- Finally, complete the declaration at the end of the form, ensuring it is signed by an authorized individual. Enter the TIN of the signatory along with their title, position, and any additional relevant details.

- Once all fields are completed, save your changes. You can also download, print, or share the form as needed.

Complete your PH BIR 1903 registration online today for a quicker and more efficient process.

Are you looking for your RDO Code? This acronym equates to Revenue District Office and the code stands for a specific location. The RDO is a sector under the Bureau of Internal Revenue or BIR which keeps records of taxpayers who fall under their jurisdiction.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.