Loading

Get Reasonable Explanation Checklist

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Reasonable Explanation Checklist online

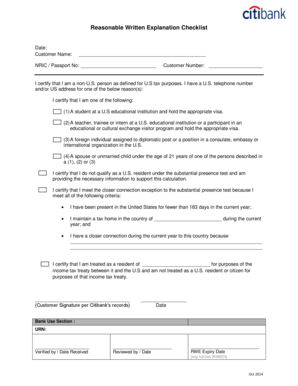

Filling out the Reasonable Explanation Checklist is a crucial step for non-U.S. persons to provide necessary information for U.S. tax purposes. This guide offers clear, step-by-step instructions on how to effectively complete the checklist online.

Follow the steps to accurately complete the checklist.

- Click ‘Get Form’ button to access the form and open it for editing.

- Begin by entering the date and your name in the designated fields. Ensure that all information is accurate.

- Provide your NRIC or passport number in the respective section. This is essential for identification.

- Enter your customer number, if applicable, to link your form to your records.

- In the certification section, indicate that you are a non-U.S. person for tax purposes, selecting one of the provided reasons that apply to you.

- If you certify as a student, teacher, or diplomat, add the necessary details, including your visa type.

- Complete the section concerning the substantial presence test by providing the number of days you have been present in the U.S. and your tax home during the current year.

- If applicable, indicate your residency status per any relevant income tax treaty and provide the name of the country.

- Sign the form where indicated, and enter the date of signing to validate your submission.

- Once all fields are completed, review your entries for accuracy. You can then save your changes, download a copy for your records, or print the form.

Start filling out the Reasonable Explanation Checklist online today to ensure your tax information is correctly submitted.

Typically, Chapter 3 represents the withholding that applies to Foreign persons, and Chapter 4 represents the withholding that applies to entities that are foreign financial institutions. You must enter either '3' or '4' in box 3 of Form 1042-S (not both chapters).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.