Loading

Get Tax Return Routing Sheet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax Return Routing Sheet online

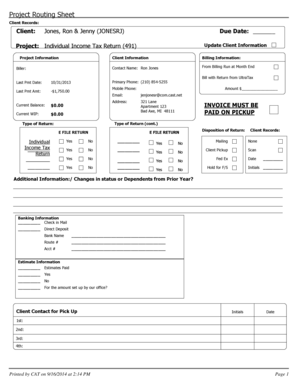

The Tax Return Routing Sheet is an essential document for efficiently managing tax return submissions. This guide provides clear, step-by-step instructions to help users complete the form accurately online.

Follow the steps to successfully complete the Tax Return Routing Sheet.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editing tool.

- In the 'Client' section, enter the names of the clients, including both first and last names. Use the format 'Last Name, First Name' followed by the designated client code.

- Fill in the 'Due Date' field with the deadline for the tax return submission.

- In the 'Project Information' section, specify the project type as 'Individual Income Tax Return' and refer to the associated project number.

- Provide details for the 'Biller', including the last payment date and amount, as well as the current balance and work-in-progress.

- Update the 'Client Information' section with contact names, phone numbers, email addresses, and mailing addresses, ensuring all details are accurate.

- Select the 'Type of Return' by checking the appropriate boxes for options like e-file return and individual income tax return.

- Complete the 'Disposition of Return' section by choosing how the client prefers to receive their return (mail, pickup, etc.).

- In the 'Banking Information' section, provide necessary details such as check mailing or direct deposit information, including bank name and account numbers.

- Indicate whether estimates were paid in the 'Estimate Information' section, and confirm the amounts set up by the office.

- Lastly, ensure all sections are complete and review the document for accuracy. Save your changes, download, print, or share the form as needed.

Begin completing your documents online today for a streamlined tax return process.

What is a route sheet? A sequence of operations to make a part. What information is included on a route sheet? Part number, part name, quantity to produce, operation numbers, operation description, machine numbers, machine games, tooling needed, and time standards.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.