Loading

Get 4506 T March 2019 Disaster

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 4506 T March 2019 Disaster online

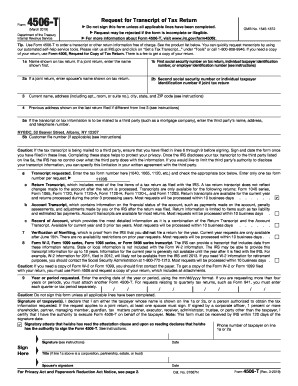

The 4506 T March 2019 Disaster form allows taxpayers to request a transcript of their tax return. This guide provides step-by-step instructions for filling out the form online in a clear and supportive manner, ensuring users of all experience levels can easily navigate the process.

Follow the steps to successfully complete the 4506 T March 2019 Disaster form online.

- Press the ‘Get Form’ button to obtain the 4506 T March 2019 Disaster form and open it for editing.

- In line 1a, enter the name shown on your tax return. If this is a joint return, input the first name listed.

- Enter the first social security number, taxpayer identification number, or employer identification number in line 1b.

- For a joint return, fill in your spouse’s name in line 2a and their respective social security number in line 2b.

- In line 3, provide your current address, including any apartment or suite numbers, city, state, and ZIP code.

- If applicable, enter your previous address as listed on the most recent return filed in line 4.

- If necessary, designate a third party to receive the transcript by completing line 5a along with their address and phone number.

- Check the appropriate box in line 6, indicating the type of transcript requested, and provide the corresponding tax form number.

- For the year or period requested, enter the ending date in the format mm/dd/yyyy in line 9.

- Sign and date the form in the signature section and ensure all relevant lines are completed to avoid rejection.

- Once completed, save your changes, then download, print, or share the form as needed.

Start filling out the 4506 T March 2019 Disaster form online today to request your tax transcript.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

All COVID EIDL applicants are required to submit a signed and dated Form 4506-T authorizing the IRS to release business tax transcripts for SBA to verify their revenue. If you receive repeated requests to submit your Form 4506-T, there may have been an error on your previous submission.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.