Loading

Get Who Has To File The Application To Fix Inheritance Tax Form On Non Probate Property

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Who Has To File The Application To Fix Inheritance Tax Form On Non Probate Property online

Filing the Who Has To File The Application To Fix Inheritance Tax Form On Non Probate Property can be a straightforward process when approached methodically. This guide provides clear steps to help users navigate the form efficiently and accurately.

Follow the steps to fill out the form online with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

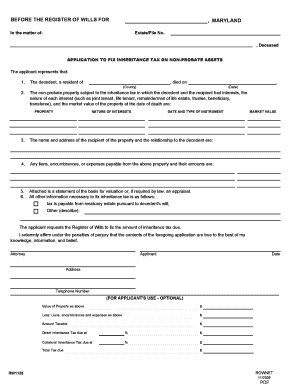

- Fill in the decedent's details, including their name, residency status, and the date of death. Make sure to enter the county of residence.

- List the non-probate property subject to inheritance tax. For each property, clearly note the nature of the interests (e.g., joint tenant, life tenant), the date and type of the legal instrument associated with the property, and the market value at the date of death.

- Provide the full name and address of the recipient of the property. Include the relationship of the recipient to the decedent to establish legal connection.

- Disclose any liens, encumbrances, or expenses connected to the property. Clearly state their amounts to calculate the taxable assets accurately.

- Attach a statement of basis for valuation or an appraisal if required by law to support your submission.

- Indicate whether the tax is payable from the residuary estate according to the decedent's will or if there are other instructions to describe.

- Review all provided information to ensure accuracy and completeness before submission.

- Finalize your application by affirming under penalty of perjury that the information is true to the best of your knowledge. Sign off as either the attorney or applicant, including the current date, address, and telephone number for contact purposes.

- Once the form is completed, save your changes, then download, print, or share the form as necessary.

Complete your forms online today to streamline the inheritance tax process.

If a deceased person owes taxes the Estate can be pursued by the IRS until the outstanding amounts are paid. The Collection Statute Expiration Date (CSED) for tax collection is roughly 10 years -- meaning the IRS can continue to pursue the Estate for that length of time.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.