Loading

Get Form 9041

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 9041 online

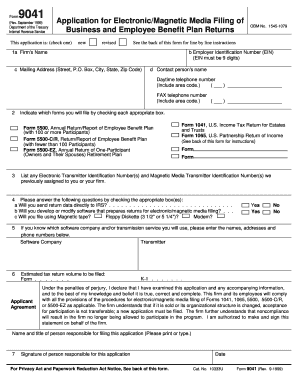

Filling out the Form 9041 is an important step for participating in the electronic filing program for various business and employee benefit plan returns. This guide provides clear instructions to help you complete the form correctly and efficiently.

Follow the steps to fill out the Form 9041 online effectively.

- Press the ‘Get Form’ button to access the form and open it in the editor.

- Fill in the firm's name in Line 1a as it appears on your tax return. Ensure accuracy to avoid delays.

- Enter the Employer Identification Number (EIN) in Line 1b. Remember, the EIN must consist of exactly 9 digits.

- Provide the mailing address in Line 1c, including street, P.O. Box, city, state, and zip code. If applicable, include both your post office box and street address for completeness.

- Complete Line 1d by specifying the contact person's name, daytime telephone number, and fax number for correspondence.

- In Line 2, indicate which forms you plan to file by checking the appropriate boxes. This can include forms such as the Form 5500 and Form 1041.

- For Line 3, list any previously assigned Electronic Transmitter Identification Numbers and Magnetic Media Transmitter Identification Numbers, if available.

- Answer the questions in Line 4 by checking the appropriate boxes regarding your filing plans and software usage. This helps clarify your method of electronic submission.

- Provide details in Line 5 about any software company or transmission service you will use, including their names and contact information.

- Estimate your tax return volume for filing in Line 6 and ensure accuracy to reflect your firm's expected workload.

- In the statement section, affirm your declaration regarding the information provided, and ensure the person responsible for filing signs the application in Line 7.

- After completing all lines, review your information for accuracy. Finally, save your changes, download a copy, or print the form for submission.

Start completing your Form 9041 online today to ensure your application is submitted promptly.

You may use Form 56 to: Provide notification to the IRS of the creation or termination of a fiduciary relationship under section 6903.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.