Loading

Get Irs Form Pr 141

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Irs Form Pr 141 online

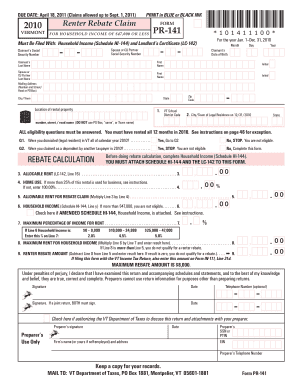

Filling out the Irs Form Pr 141 online can streamline your renter rebate claim process. This guide will walk you through each step of the form, ensuring you understand the necessary information and requirements for successful submission.

Follow the steps to complete your Irs Form Pr 141 online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Enter the claimant's Social Security number. If applicable, include the Social Security number for your spouse or civil union partner.

- Fill in the claimant's date of birth, ensuring to format it as MM DD YYYY.

- Input the claimant's last name, first name, and any initials.

- Provide the mailing address, ensuring to use the correct format without a PO Box, ‘same,’ or town name.

- Specify the location of the rental property by providing the number, street or road name, avoiding any postal box formats.

- Complete the eligibility questions thoroughly; answering ‘Yes’ or ‘No’ as applicable. Ensure to determine eligibility based on the questions provided.

- Calculate allocable rent, entering it from the landlord’s certificate (LC-142) under the specified line.

- Determine the percentage of home use versus business use to correctly complete the calculation for allowable rent.

- Complete the household income section by entering the specified amount, ensuring it does not exceed the eligibility threshold.

- After entering all necessary fields and calculations, ensure that you review all entries for accuracy.

- Save your changes, download the completed form, and if needed, either print or share the form as required.

Start filling out your Irs Form Pr 141 online today to secure your rebate.

You meet the “household income” criteria (up to $136,900 for calendar year 2021).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.