Loading

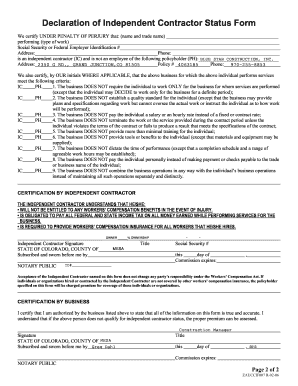

Get Declaration Of Independent Contractor Status Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Declaration Of Independent Contractor Status Form online

Filling out the Declaration Of Independent Contractor Status Form online is a straightforward process that ensures compliance with the Colorado Workers' Compensation Act. This guide will provide you with clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to access the form and open it in your chosen online editor.

- Begin by entering your full name and trade name in the designated fields. This information identifies the independent contractor.

- Next, provide your Social Security number or Federal Employer Identification number in the appropriate field. This information is vital for tax and identification purposes.

- Enter your contact phone number and your address to ensure accurate communication regarding your status.

- Indicate the name of the policyholder you are contracting with, which in this case is BLUE STAR CONSTRUCTION, INC. Also, fill in their policy number, phone, and address.

- Review the criteria outlined in the form. You must confirm that the policyholder meets the criteria for independent contractor status by providing your initials where applicable.

- Sign the section certifying your understanding of your rights and responsibilities, including the non-entitlement to workers' compensation benefits and tax obligations.

- Complete the business certification section, where the authorized individual from the business will sign and provide notarization.

- Once all sections are filled out, review the form for accuracy. Save your changes, then download, print, or share the form as necessary.

Complete and submit your Declaration Of Independent Contractor Status Form online today to ensure your compliance with Colorado regulations.

In California, workers who report their income on a Form 1099 are independent contractors, while those who report it on a W-2 form are employees. Payroll taxes from W-2 employees are automatically withheld, while independent contracts are responsible for paying them.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.