Loading

Get Csinfo Tcadcentral Org

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Csinfo Tcadcentral Org online

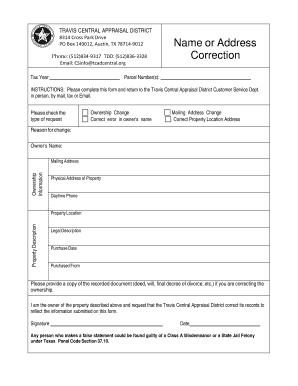

This guide provides detailed instructions on how to accurately fill out the Csinfo Tcadcentral Org form. Following these steps will ensure that your request is processed efficiently and effectively.

Follow the steps to complete your online correction request.

- Press the ‘Get Form’ button to access the form online and open it for editing.

- Fill in the tax year for which you are requesting a correction. This information can typically be found on previous tax documents related to the property.

- Provide the parcel number(s) associated with the property. This number is essential for identifying the specific property in question.

- Select the type of request you are making by checking the relevant box. Options include ownership change, mailing address change, or correcting an error in the owner's name.

- Specify the reason for the change in the corresponding field. Clear and accurate explanations will help streamline the process.

- Input the owner's name as it should be recorded, ensuring that all details are correct to prevent any further issues.

- Provide the mailing address and the physical address of the property. Confirm that these addresses are current to avoid any miscommunication.

- Include your daytime phone number for any follow-up questions regarding your request.

- Fill out additional property description details, such as the legal description of the property and the date it was purchased.

- If applicable, attach a copy of the recorded document (such as a deed or final decree) that supports your request for correcting ownership.

- Sign and date the form to confirm that you are the owner of the property and that the information submitted is accurate.

- Once completed, you can save your changes, download the form, print it, or share it as needed for submission to the Travis Central Appraisal District.

Complete your correction request online today to ensure your property records are accurate.

If, after 90 days from the date of the closing the property, the appraisal records do not reflect the current ownership, please contact the Travis Central Appraisal District at (512) 834-9317.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.