Loading

Get Lrs Declaration

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Lrs Declaration online

Filling out the Lrs Declaration online is a straightforward process that ensures your application for drawing foreign exchange is completed correctly. This guide will walk you through each section of the form to help you submit it without any issues.

Follow the steps to complete the Lrs Declaration successfully.

- Click 'Get Form' button to obtain the form and open it in an editor.

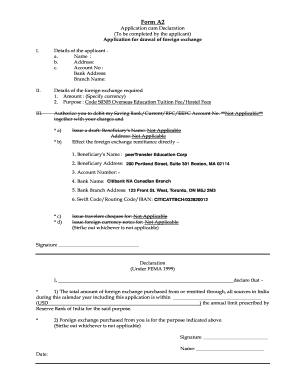

- In the first section, provide the details of the applicant. Fill in your name, address, and account number. Ensure that the bank address and branch name are also completed accurately.

- In the second section, specify the amount of foreign exchange required, mentioning the currency. Under the purpose, select 'S0305 Overseas Education Tuition Fee/Hostel Fees' to indicate your intent clearly.

- If you wish to utilize your bank account for the transaction, authorize the debit by entering the specified saving bank, current, RFC, or EEFC account number. Leave this section blank if it is not applicable.

- To issue a draft, enter the beneficiary's name and address. If you are not issuing a draft, indicate by marking ‘Not Applicable.’ If remittance is preferred, enter the details of the beneficiary, including 'peerTransfer Education Corp' and its address.

- Fill in the beneficiary's account number, bank name (Citibank NA Canadian Branch), bank branch address, and swift code if applicable. Mark any options that do not apply as ‘Not Applicable.’

- For the declaration section, affirm that the total amount of foreign exchange purchased is within the annual limit prescribed by the Reserve Bank of India. Fill in the total amount in USD as required.

- Sign and date the document at the specified points. Ensure all fields are correctly filled out and reviewed before proceeding.

- Once you have completed all sections, save your changes, download the form, or print it as necessary for your records.

Complete your Lrs Declaration online today to ensure a smooth foreign exchange process.

The Liberalised Remittance Scheme (LRS) is part of the Foreign Exchange Management Act (FEMA) 1999 which lays down the guidelines for outward remittance from India. Under LRS, all resident individuals, including minors, are allowed to freely remit up to USD250,000 per financial year (April – March).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.