Loading

Get 2019 Schedule Icr

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2019 Schedule Icr online

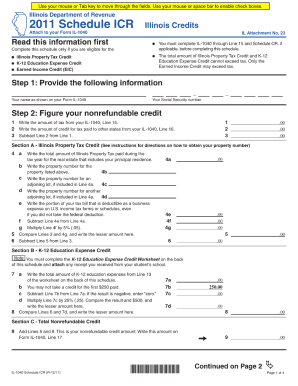

The 2019 Schedule Icr is an important document for reporting specific financial information. This guide will walk you through the process of completing the form online, ensuring you have a clear understanding of each section.

Follow the steps to fill out your Schedule Icr accurately

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your identifying information, including your name and address. Ensure that all entries are accurate and up-to-date, as this information will be used for correspondence.

- In the income section, report your earnings as specified. Take care to use the correct categories and provide details about your sources of income.

- Next, move to the deductions portion of the form. List any deductions you qualify for, referencing relevant documentation to support your claims.

- Once all information is entered, review each section to ensure accuracy. Pay special attention to numbers and ensure they align with any supporting schedules.

- After reviewing your entries, you can proceed to save your changes. You may also choose to download, print, or share the completed form as needed.

Complete your 2019 Schedule Icr online today to ensure timely and accurate submission.

You will qualify for the property tax credit if: your principal residence during the year preceding the tax year at issue was in Illinois, and. you owned the residence, and. you paid property tax on your principal residence (excluding any applicable exemptions, late fees, and other charges).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.