Loading

Get Home Equity Loan Modification Application Loan...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the home equity loan modification application online

Completing the home equity loan modification application online can simplify the process of managing your loan. This guide will provide you with step-by-step instructions to ensure that you fill out the application accurately and efficiently.

Follow the steps to complete your application successfully.

- Click ‘Get Form’ button to download the home equity loan modification application form and open it for editing.

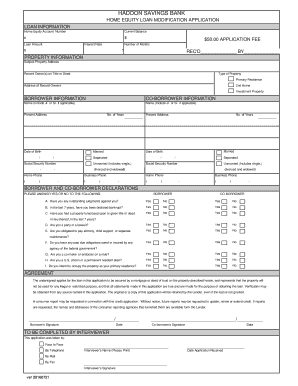

- Begin by filling out the loan information section. Enter your home equity account number, current balance, loan amount, interest rate, application fee, and number of months for the loan.

- In the property information section, provide the subject property address and the names of the record owner(s) as they appear on the title or deed. Select the type of property by checking the appropriate box (primary residence, second home, or investment property).

- Navigate to the borrower information section. Fill in your name, current address, number of years at that address, date of birth, marital status, home phone number, business phone number, and social security number.

- If there is a co-borrower, complete the co-borrower information section using the same details as above, including the name, present address, number of years at that address, date of birth, marital status, home and business phone numbers, and social security number.

- Answer the borrower and co-borrower declarations section by indicating yes or no for each question related to judgments, bankruptcy, foreclosures, lawsuits, and obligations.

- Review the agreement section carefully and ensure that all statements made in this application are true. Both borrower and co-borrower need to sign and date the application at the designated spaces.

- Lastly, if an interviewer is involved, they will complete their section regarding the method of application and provide their name and signature.

- Once all sections are filled out, save your changes. You have the option to download, print, or share the completed application.

Take the next step in managing your home equity loan by completing your application online today.

Here are some tips for writing an effective letter and an easy-to-follow template to guide you. Keep your letter to a single page. Include income and asset documentation such as pay stubs, bank statements, and other relevant paperwork. Stick to the facts. ... Let the lender know the specific concession you are requesting.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.