Loading

Get Mtc Uniform Sales & Use Tax Certificate - Multijurisdiction 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MTC Uniform Sales & Use Tax Certificate - Multijurisdiction online

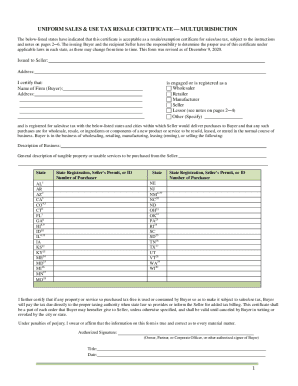

The MTC Uniform Sales & Use Tax Certificate - Multijurisdiction is an essential document for buyers seeking tax exemption for resale purchases across multiple states. This guide provides clear, step-by-step instructions on completing this form online to ensure compliance and avoid unnecessary tax obligations.

Follow the steps to fill out the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the section labeled 'Issued to Seller', input the legal name of the seller and their complete address. This identifies the recipient of the certificate.

- In the 'Name of Firm (Buyer)' section, provide your business name, followed by your address. Ensure that it accurately reflects the entity that is purchasing the goods.

- Tick the appropriate box describing your business type: wholesaler, retailer, manufacturer, seller, lessor, or other. This indicates your role in the transaction.

- Under 'Description of Business', write a brief summary of your business activities that justify the purchase of goods for resale.

- In the section labeled 'General description of tangible property or taxable services to be purchased from the Seller', describe the kinds of items or services you intend to buy.

- For each state listed in the form, enter your state registration or seller’s permit number on the corresponding line. This number identifies your tax registration with those states.

- For any property or service purchased tax-free, acknowledge your responsibilities regarding tax payment if used differently by marking the appropriate certification checkbox.

- Provide your authorized signature, title, and the date at the bottom of the form. Only authorized individuals — such as owners or partners — should sign.

- Save your changes, and then choose to download, print, or share the completed form as needed.

Complete your MTC Uniform Sales & Use Tax Certificate - Multijurisdiction online and ensure compliance with state tax regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.