Loading

Get Uk Hmrc Iht30 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK HMRC IHT30 online

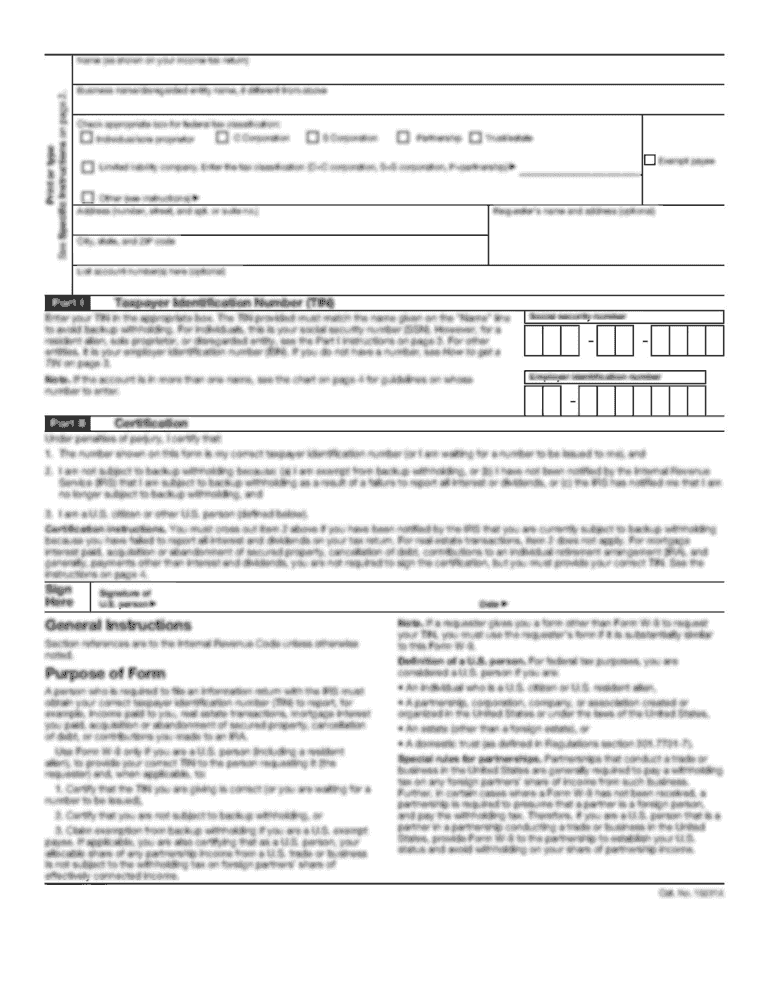

The UK HMRC IHT30 form is an important document used to apply for a clearance certificate regarding inheritance tax matters. This guide will provide comprehensive steps to help you navigate through the online completion of the IHT30 form with ease.

Follow the steps to fill out your UK HMRC IHT30 form correctly.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- In the box on the left, fill in the full name and address of the person to whom HMRC should send the certificate. Include any relevant references, phone number, and postcode.

- Move to Section A and provide the inheritance tax reference number that this application relates to, along with the date of the event (such as death, transfer, or settlement creation) in the format DD MM YYYY.

- Specify the type of account relevant to the application (for example, IHT100 or IHT400). Then, provide the date of amendments to the account and the date the account was sent to HMRC using the same date format.

- In this section, enter the date of calculations from HMRC and the name related to the estate (e.g., deceased or transferor). Ensure you complete all date fields that are required for clarity.

- Check the declaration box confirming that, to the best of your knowledge, there will be no further changes to the values provided in the estate and that all material facts have been disclosed. It is crucial to only declare if you are confident about the values being final.

- Proceed to Section B to provide a declaration by the appropriate person. Individuals should enter their name, provide their signature, state their capacity (e.g., executor or trustee), and include the date.

- Ensure that all parties who need to sign have done so by repeating the previous step as necessary for additional signatories.

- Once all sections are filled accurately, review the completed form for any errors or missing information.

- Save changes, download, print, or share the form as needed according to your preference and submit it as directed.

Complete your HMRC IHT30 form online today to streamline your inheritance tax clearance process.

Related links form

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.