Loading

Get Uk Hmrc P356 2019-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK HMRC P356 online

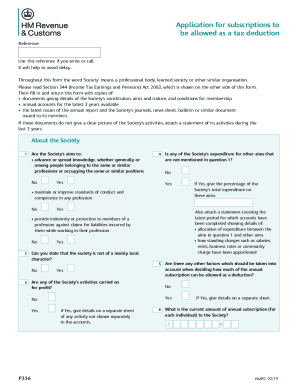

Filling out the UK HMRC P356 form can provide valuable tax deductions for subscriptions related to professional bodies. This guide offers a step-by-step walkthrough to ensure that you complete the form correctly and efficiently, helping you navigate the necessary fields with ease.

Follow the steps to complete the UK HMRC P356 form effectively.

- Press the ‘Get Form’ button to retrieve the UK HMRC P356 form and access it in your preferred editor.

- Begin by entering the name of the society in the designated field. Ensure that the name is accurately spelled and corresponds exactly with official documentation.

- Provide the address of the society, including the post code. Verify that this information matches the society's official records.

- In question one, evaluate the aims of the society. Answer either ‘Yes’ or ‘No’ based on whether the society's objectives aim to advance knowledge or maintain standards within the profession.

- For question two, indicate whether any of the society's expenditures relate to aims not mentioned in question one. Again, respond with ‘Yes’ or ‘No’ and provide additional details if applicable.

- Complete the section about the society's activities, including a numerical value for the current annual subscription per individual. Make sure this amount is accurate.

- In the declaration section, confirm that you have read the relevant section of the Income Tax (Earnings and Pensions) Act 2003. Sign and print the name of the responsible officer of the society, along with their position and email address.

- Finally, review all provided information for accuracy, and save your changes. You can choose to download, print, or share the completed form as needed.

Start filling out your UK HMRC P356 form online today to ensure you receive your tax deduction!

What HM Revenue & Customs does. We are the UK's tax, payments and customs authority, and we have a vital purpose: we collect the money that pays for the UK's public services and help families and individuals with targeted financial support. ... HMRC is a non-ministerial department, supported by 2 agencies and public bodies ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.