Loading

Get Irs 14950 2016

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 14950 online

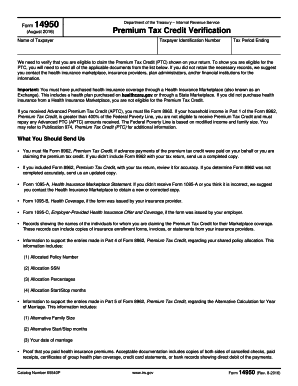

The IRS 14950 form is used for Premium Tax Credit verification. This guide will provide you with comprehensive instructions on how to fill out the form online, step by step, ensuring that you complete it accurately and understand what is required.

Follow the steps to fill out the IRS 14950 confidently.

- Click the ‘Get Form’ button to access and open the IRS 14950 form in your preferred online format.

- Enter your name in the designated field. This should be the name of the taxpayer claiming the Premium Tax Credit.

- Input your Taxpayer Identification Number (TIN). Ensure the number is accurate, as it is crucial for identification purposes.

- Fill in the tax period ending date. This date indicates the end of the tax year for which you are claiming the Premium Tax Credit.

- Gather and prepare the necessary documentation. You must provide documents that prove your eligibility for the Premium Tax Credit, as outlined in the form. These include Form 8962, 1095-A, and other related materials.

- Review all information entered in the form for accuracy. Ensure that your details match with the supporting documents you will send.

- Once you have completed and reviewed the form, you can save the changes. Choose to download, print, or share the form as needed based on the requirements of your submission.

Complete your IRS 14950 form online today to ensure your Premium Tax Credit verification process is smooth and efficient.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Form 8379 Where to Mail. You print and mail to IRS center for the area where you live and you can go here to find address for center for your area https://www.irs.gov/uac/where-to-file-paper-tax-returns-with-or-without-a-payment.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.