Loading

Get Policy Lapsed

How it works

-

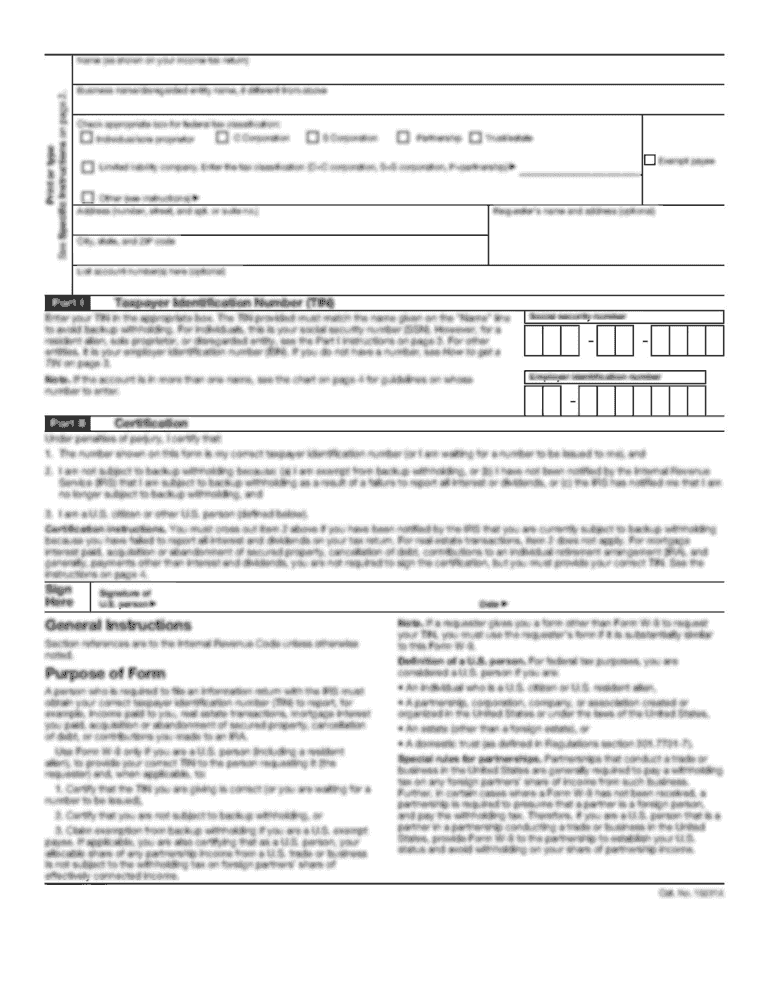

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Policy Lapsed online

This guide will provide you with clear instructions on how to effectively fill out the Policy Lapsed form online. By following these steps, you can ensure that your submission is complete and accurate.

Follow the steps to successfully complete your Policy Lapsed form.

- Press the ‘Get Form’ button to access the Policy Lapsed form online.

- In the form, locate the 'Policy Number' field and enter the policy number provided in your notice (e.g., C01234567).

- Fill in the 'Insured Name' field with the name of the insured individual as indicated in the notice.

- Navigate to the 'Total Amount Due' section and confirm the amount listed ($00.00) is correct, then proceed to enter your payment amount in the designated area.

- In the address section, verify and update your address if necessary, using the 'New Address' fields if you have recently moved.

- If your payment serves a different purpose than described, provide the relevant details in the 'Special Instructions' area.

- Review all completed sections of the form carefully to ensure accurate information has been entered.

- Once you are satisfied with your entries, you can either save your changes, download the form, print it, or share it as needed.

Complete your Policy Lapsed form online today to restore your coverage.

A life insurance policy may typically be reinstated within 30 days of a lapse without additional paperwork, underwriting, or attestations of health. Insureds often pay a reinstatement premium, which is larger than the original premium.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.