Loading

Get Transunion - Fraud Alert Removal Letter - How To Remove Fraud Alert - Idispute.org

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TransUnion - Fraud Alert Removal Letter - How To Remove Fraud Alert - IDispute.org online

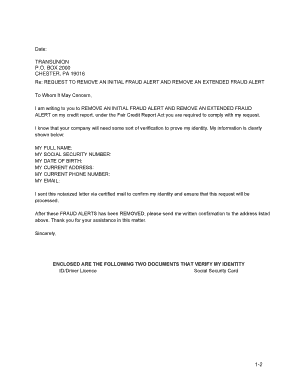

Removing a fraud alert from your credit report is a necessary step for regaining control over your financial identity. This guide provides clear and detailed instructions on completing the TransUnion - Fraud Alert Removal Letter to facilitate this process seamlessly.

Follow the steps to complete the removal letter accurately.

- Click ‘Get Form’ button to acquire the form and open it in your preferred editing tool.

- Begin by filling in the date at the top of the form. This helps establish a timeline for your request.

- Next, locate the address section and provide the contact details for Equifax Information Services LLC as indicated in the document.

- In the body of the letter, clearly state your request to remove both the initial and extended fraud alerts. Use language that asserts your rights under the Fair Credit Reporting Act.

- Insert your personal information in the designated fields: full name, social security number, date of birth, current address, phone number, and email. Ensure accuracy for verification.

- Mention that you have sent a notarized letter via certified mail as additional verification. This reinforces the legitimacy of your request.

- Request written confirmation of the removal of the fraud alerts to be sent to your address. This is essential for your records.

- Provide a closing statement with 'Sincerely' followed by your name, and ensure that the letter appears professional.

- Finally, review the letter for any errors. Once satisfied, you can either save changes, download, print, or share the completed document.

Take control of your credit today — complete your fraud alert removal letter online!

Initial fraud alerts and active-duty alerts expire after one year, and extended fraud alerts remain on your credit reports for seven years unless you request the alert to be removed sooner.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.