Loading

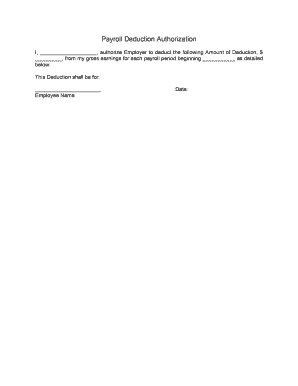

Get Payroll Deduction Authorization

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Payroll Deduction Authorization online

This guide provides clear and thorough instructions on how to complete the Payroll Deduction Authorization form online. By following these steps, you can ensure that your payroll deductions are processed accurately and efficiently.

Follow the steps to complete your Payroll Deduction Authorization form online.

- Click the ‘Get Form’ button to access the Payroll Deduction Authorization. This will allow you to download and open the form in your preferred online editor.

- In the first blank field, enter your name as the employee who is authorizing the deduction. Ensure that the name is spelled correctly and matches your payroll records.

- In the following field, specify the amount to be deducted from your gross earnings for each payroll period. This should be a clear monetary value, such as $50.00.

- Indicate the date from which the deduction will begin. Be sure to format the date correctly, typically as MM/DD/YYYY.

- In the section that details what the deduction is for, provide a brief description. This could be for items like insurance, savings, or other deductions.

- Finally, review the form for any errors and ensure that all required fields are filled out. Once reviewed, you can save your changes, download a copy, print it, or share it as needed.

Complete your Payroll Deduction Authorization online today to streamline your payroll process.

Authority to Deduct means the confirmatory authorisation provided by the Employee in the agreement between the employee and the Bank, authorising the Employer to make deductions from the employee's salary or wage.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.