Loading

Get Self-employment (short) (2019). If You 're Self-employed, Have Relatively Simple Tax Affairs And

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Self-employment (Short) (2019) if you are self-employed and have relatively simple tax affairs online

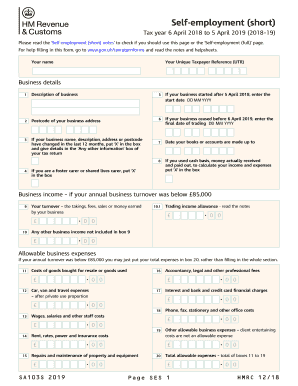

Filling out the Self-employment (Short) form for the tax year 2018-19 can be straightforward if you follow the right steps. This guide provides a clear and professional approach to ensure that you accurately complete the form online, tailored to your self-employment needs.

Follow the steps to effectively complete the Self-employment (Short) form online.

- Click the ‘Get Form’ button to download the form to your device and open it in your preferred editing tool.

- Begin by entering your name in the designated field. Ensure that you use your full legal name as recognized by financial authorities.

- Input your Unique Taxpayer Reference (UTR) number. This is essential for identifying your tax records with the HMRC.

- In the business details section, provide a clear description of the nature of your business. This should relate directly to your activities.

- Fill in the postcode for your business address to help verify your location for tax purposes.

- If your business started after 5 April 2018, enter the start date in the format DD MM YYYY.

- In case your business ceased trading before 6 April 2019, fill in the final date of trading in the specified format.

- Indicate the date your records or accounts are made up to, ensuring it corresponds with your financial reporting period.

- If you used the cash basis to calculate your income, mark the box provided to indicate that you are reporting based on actual cash received and paid.

- Enter your annual turnover from your business in box 9. This figure represents the total income generated from your business activities.

- In box 10, list any additional business income that is not captured in box 9.

- If your annual turnover was below £85,000, simply enter your total allowable business expenses in box 20, instead of detailing expenses in the separate sections.

- Complete the additional fields on allowable business expenses, entering specific amounts where applicable, such as for goods bought, travel expenses, and professional fees.

- Calculate your net profit or loss based on the figures you have inputted. If your income exceeds expenses, enter the profit in box 21; otherwise, report a loss in box 22.

- Proceed to fill in any capital allowances and adjustments needed to calculate your taxable profits for the year.

- Review your entries thoroughly before finalizing your form to ensure accuracy and completeness.

- Once you are satisfied with your form, save your changes and download or print it for your records. Follow any further instructions to submit the form online.

Complete your self-employment documentation online today for a streamlined filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Self-employed persons, including direct sellers, report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Use Schedule SE (Form 1040), Self-Employment Tax if the net earnings from self-employment are $400 or more.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.