Loading

Get Form 886 I

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 886 I online

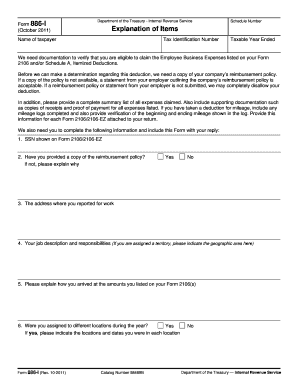

Filling out Form 886 I online is a straightforward process that guides users through the necessary steps to provide the Internal Revenue Service with required documentation for claiming Employee Business Expenses. This guide aims to clarify each section of the form, ensuring that users can complete it accurately and efficiently.

Follow the steps to complete the Form 886 I online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Start by entering your Tax Identification Number in the designated field at the top of the form. This is critical for identifying your tax records.

- Next, provide your full name as the taxpayer. Ensure that this matches the name on your tax return.

- Indicate the taxable year ended that you are filing for. This is important to establish the correct tax period.

- Carefully read the instructions regarding documentation for Employee Business Expenses. Prepare copies of your company’s reimbursement policy or a statement from your employer, as well as a summary list of all expenses claimed.

- For expenses related to mileage, include logs that document your trips. Provide verification of the starting and ending mileage as indicated in the log.

- Complete the required information at the bottom of the form, including your SSN as shown on Form 2106/2106-EZ and answers to specific questions regarding the reimbursement policy and your work address.

- Finally, review all the information entered to ensure accuracy. Save changes, and you can choose to download, print, or share the completed form as needed.

Complete your documents online to ensure a smooth filing experience.

Generally, to qualify for head of household filing status, you must have a qualifying child or a dependent. However, a custodial parent may be eligible to claim head of household filing status based on a child even if he or she released a claim to exemption for the child.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.